working capital turnover ratio formula class 12

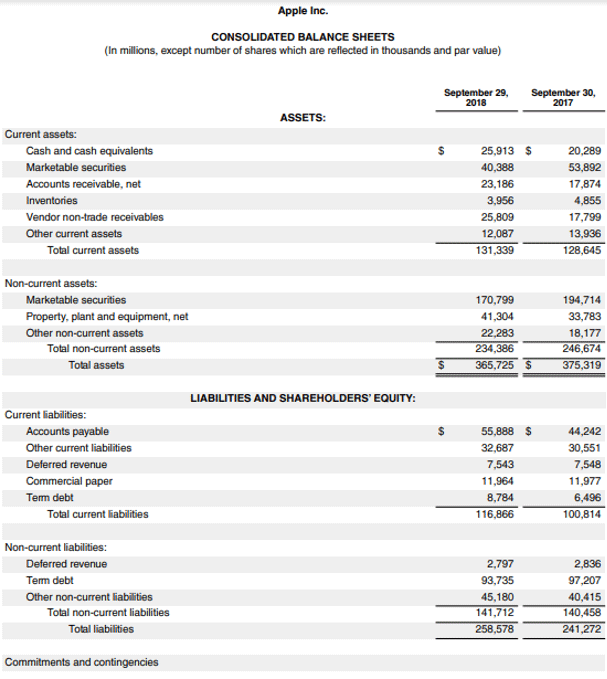

Current Ratio 900000300000. Net Working Capital and Revenue from Operations ie Net Sales.

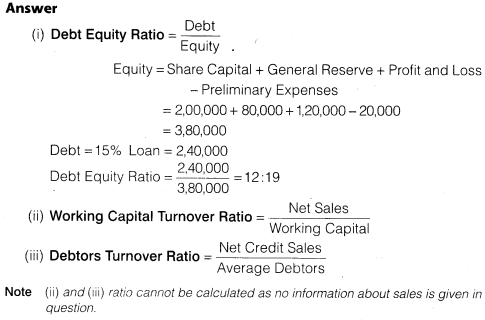

Dk Goel Solutions Class 12 Accountancy Chapter 5 Accounting Ratios

Capital Turnover Ratio 500000 40000 125 Interpretation It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company.

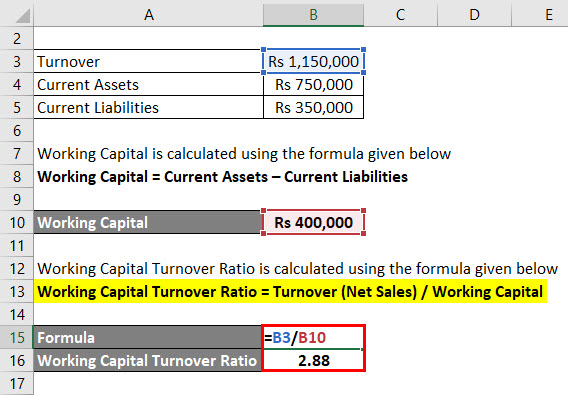

. Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. Working capital Current assets - Current liabilities Working capital 550000 - 180000. Working capital Turnover ratio Net Sales Working Capital 420000 60000 7.

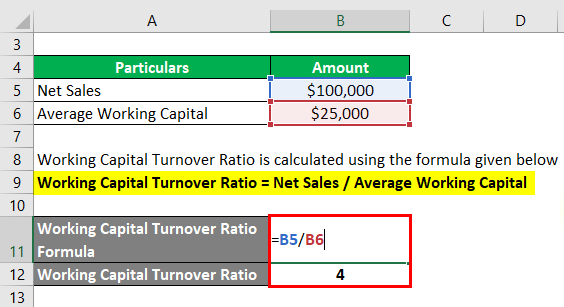

Working capital turnover Net annual sales Working capital. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Working Capital Current assets - Current liabilities 600000 900000 - Current liabilities Current liabilities 300000.

Net Working Capital Current assets Current liabilities. It establishes the relationship between. Current Ratio 3 1 Workings.

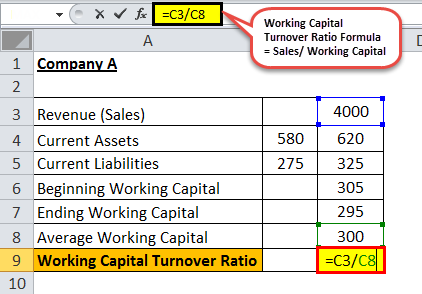

Working capital turnover ratio 1850000370000. Working Capital Turnover Ratio Formula. Working Capital Turnover Ratio Cost of Sales Net Working Capital.

300000 Inventory Turnover Ratio 6 times. Find out of opening stock if opening stock is Rs. 6 Debt- equity ratio.

Working Capital is 90000. Calculate the amount of Current Assets and Current Liabilities. 10000 less than the closing stock.

It signifies that how well a company is generating its sales with respect to the working capital of the company. Working Capital Current Assets Current Liabilities. Ratios even help in co-ordination which is of at most importance in effective business management.

Net Working Capital Current Assets excluding Fictitious assets Current liabilities. Working Capital Turnover Ratio. Work out the following ratios- 1 Net profit after tax ratios.

Revenue from the operation for the year were RS. Cost of sales Rs. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for. Accounting Ratios CBSE Notes for Class 12 Accountancy Topic 1. The working capital formula is.

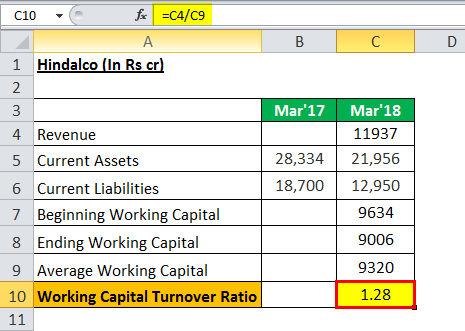

Working capital turnover ratio interpretation. Working capital turnover ratio 5 Times Working note 1. The working capital turnover ratio is thus 12000000 2000000 60.

Take the Next Step to Invest. The questions and answers of how is provision for doubtful debt a part of current liability in inventory turnover ratio and working capital turnover ratio are solved by group of students and teacher of class 12 which is also the largest student community of class 12. The formula for calculating working capital turnover ratio is.

12 00000. Current Assets 10000 5000 25000 20000 60000. This means that every dollar of working capital produces 6 in revenue.

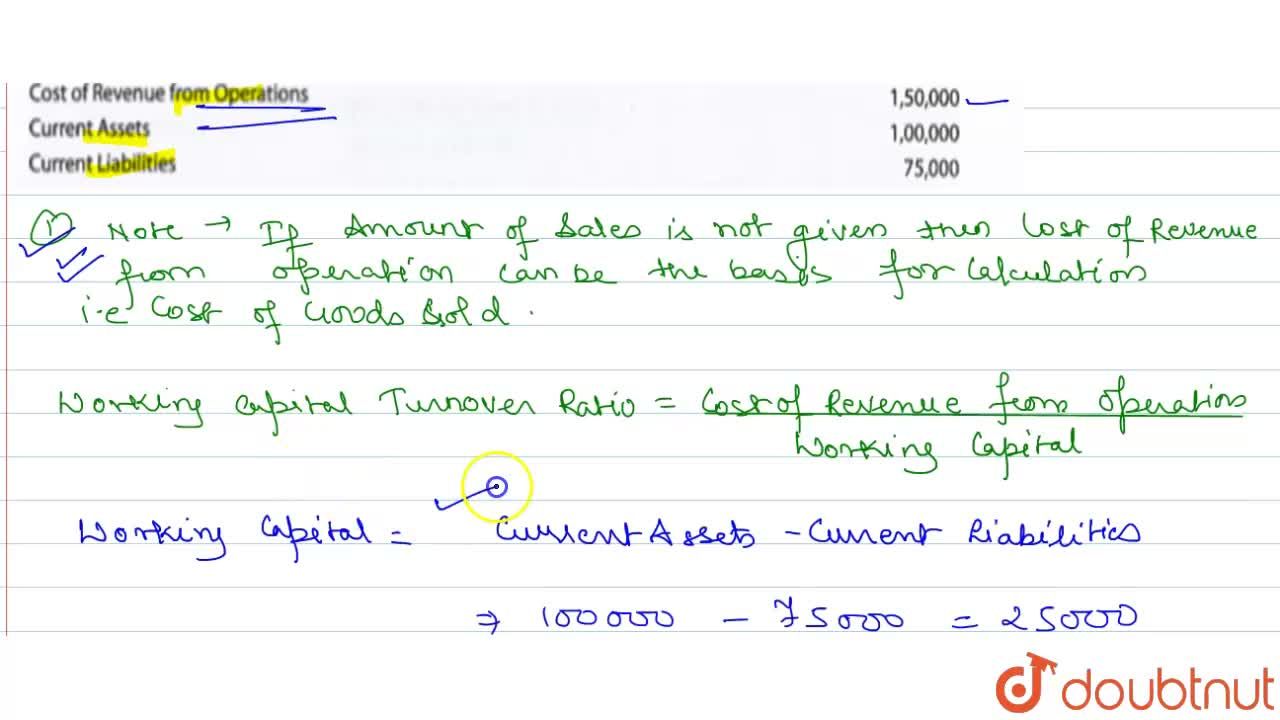

When ratios are calculated on. Working capital turnover ratiocost of revenue from operations or revenue from operations i. Putting the values in the formula of working capital turnover ratio we get.

Current Liabilities 30000. 3 Earning on equity share capital. This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return.

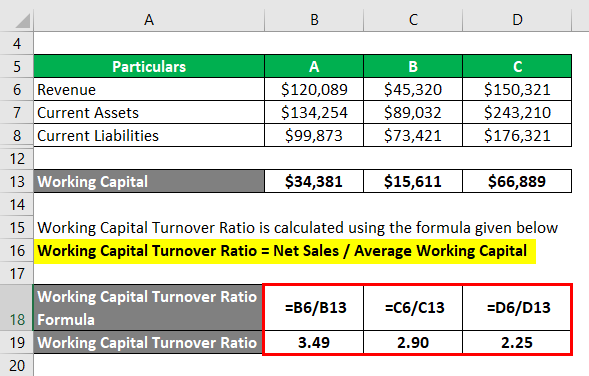

Working Capital Turnover Ratio 6 Times Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets of working capital should be compared to the previous years data as well as other players in the industry to get a better sense. This means that for every 1 spent on the business it is providing net sales of 7. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling.

The working capital of a company is the difference between the current assets and current liabilities of a company. Accounting Ratios It is a mathematical expression that shows the relationship between various items or groups of items shown in financial statements. From the following information compute the current ratio.

The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. Working capital turnover ratio Sale or Costs of Goods Sold Working Capital. Helps in control- Ratio analysis even helps in making effective control of businessThe.

Working Capital Turnover Ratio 1. Ratio It is an arithmetical expression of relationship between two related or interdependent items. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

Better communication of efficiency and weakness of an enterprise result in better co-ordination in the enterprise 5. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. The formula for calculating working capital turnover ratio is.

If a company has a higher level of working capital it shows that the working capital of the business is utilized properly and on the other hand a low working capital suggests that business has too many debtors and the inventory is unused. Current Ratio is 351. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

2 Return on capital employed. Working Capital turnover ratio Accounting Ratio Activity ratio class 12 Accounts video 110class 12 Accountsaccounting ratiosworking capital turnover. When inventory and current assets given Ratio Analysis Class 12 Example 10.

Working Capital Turnover Ratio 15000 2500. From the following information calculate the working capital turnover ratio.

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Compute Working Capital Turnover Ratio If The Cost Of Goods Sold Is Rs 9 60 000 Gross Profit Ratio Is 20 And Excess Of Current Assets Over Current Lia Accountancy Topperlearning Com Cgwwfl99

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Find Net Working Capital Formula

Working Capital Turnover Ratio Meaning Formula Calculation

Ts Grewal Solution Class 12 Chapter 4 Accounting Ratios 2020 2021

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

Reporting And Analyzing Current Liabilities India Dictionary

How To Calculate Working Capital Turnover Ratio Flow Capital

Calcualte Working Capital Turnover Ratio Form The Following Rs Cost Of Revenue Form Opertions 150000 Current Assets 100000 Current Liabilites 75000

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios